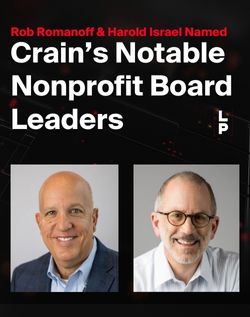

Financial Services & Restructuring

Acting as a guide for commercial lenders and borrowers.

The Financial Services & Restructuring Group (FSRG) at LP has extensive experience in commercial lending practice for both lenders and borrowers, including commercial lending, asset-based lending, and real estate lending, as well as all aspects of restructuring, whether in court or out of court, including representation of troubled companies, secured lenders, unsecured creditors, buyers of assets, creditor committees, and fiduciaries.

Meet Our Practice Group

“Thank you for all the work over the years; the company wouldn’t be here without you.” —FSRG client

Focus Areas

For lenders

Commercial lending and leasing

We represent a highly diverse group of commercial lenders and leasing companies in both the documentation of credit facilities and workouts or litigation of special assets. The group also represents buyers and sellers of individual loans and loan portfolios.

Our clients include banks, finance companies, commercial leasing companies, and commercial lenders, as well as private equity funds and individuals. Our lender representation in real estate-related loans is particularly extensive, with experience in construction financing, permanent financing, mezzanine loans, and various hybrid finance products. Our attorneys are proficient in many complex areas, including technology lending, condominium lending, contractor lending, construction lending, and financing of other lenders (e.g., mortgage-based lenders) and loans in connection with Employee Stock Ownership Plans (“ESOPs”). Our team also offers a wealth of experience in understanding government-backed loans, including 7a, 504, B&I loan programs, construction, and “piggyback” programs offered through the U.S. Small Business Administration and the U.S. Department of Agriculture.

Hard money lending / private money lending

Whether you call it “hard money lending” or “private money lending,” there is no doubt you are assuming more risk and increasing the potential for litigation.

LP works with a wide range of hard money lenders, including real estate lenders, equipment lenders, commercial and industrial lenders, finance companies, conventional banks, and family offices to provide experienced counsel and hands-on support for:

- Structuring the loan

- Assessing risks

- Drafting the necessary and appropriate documents

- Properly securing the collateral

- Closing the deal

- Handling default, forbearance and workout strategies, litigation (including bankruptcy), and disposition of the collateral assets once recovered

We start by assessing the opportunity and risk, based not only on the initial terms but also on the likelihood of recovery—including timeline and costs of seeking recovery—should the loan default.

Our ability to move quickly, provide a single and experienced point of contact, and have a single lead partner handle both the deal documents and the litigation or workout process makes LP your go-to legal firm for private money lending.

For borrowers

We represent borrowers in various industries, including manufacturing, real estate, retail, food, senior living and healthcare, service industries, and ESOPs, in lending transactions and negotiate loan facilities that best meet their needs, including cash flow, asset-based, and hard money loans. As circumstances change, we work with our borrower clients to identify the structure that will minimize their costs and allow them to grow their businesses. The services we provide include, among others:

- Reviewing term sheets and negotiating loan documents

- Assisting in times of distress (negotiating forbearance agreements and modifications with lenders)

- Helping buy and sell loans

AI and Technology

We leverage a multidisciplinary team at the forefront of AI, GenAI, and similar technologies — both established and emerging. We combine our deep industry experience with focused legal knowledge of the transactional, litigation, intellectual property, information technology, employment, cybersecurity, and data privacy issues that come into play when adopting these technologies. Click here to learn more.

Restructuring

LP’s Financial Services & Restructuring Group has deep experience in all facets of in-court and out-of-court restructurings and workouts. Our attorneys have led engagements across the United States and internationally. Our prominent restructuring attorneys are keenly familiar with the market and strategic options, and maintain a vast network of connections, thereby enabling us to provide tailored advice that achieves unprecedented results in an efficient and cost-effective manner.

Troubled companies

We regularly help distressed businesses manage their financial and legal challenges. We are well versed in the Bankruptcy Code as well as bankruptcy alternatives, including assignments for the benefit of creditors, “friendly” foreclosures, and orderly liquidations.

After identifying the goal, we work with our clients to achieve the most cost-effective way to meet that goal. We facilitate communications with creditors to, hopefully, reach a compromise without the need for a costly dispute resolution process. If needed, however, we are well-equipped to advocate for our client’s position in court when it is appropriate. We have successfully litigated numerous bankruptcy issues, including cash collateral and adequate protection disputes, post-petition financing contests, automatic stay disputes, and contested confirmation hearings.

Secured lenders

We have a long history of protecting lenders’ interests when their loans go into default. We work with our lenders to determine the best way to get repaid, including:

- Insolvency/Restructuring: Chapter 7/Chapter 11

- Debtor-In-Possession Financing

- Cash Collateral

- Section 363 Sales/Credit Bid

- Plan/Disclosure Statement

- Automatic Stay

- Assignments for the Benefit of Creditors

- Receiverships

- UCC Sale/Disposition (consensual and non-consensual)

- Deeds in Lieu of Foreclosure

- Dissolution/Sale

- Forbearance/Amendments

- Litigation

- Note/Guaranty Actions

- Commercial Foreclosure

- Commercial Evictions

- Replevin/Detinue

- Note sales and purchases

- Agriculture-Specific Options (agricultural and farm leases, agricultural and timber property acquisition and disposition)

Unsecured creditors and creditor committees

Our nationwide creditor practice has represented the following in bankruptcy and other litigation cases around the country:

- Commercial landlords when their tenants breach their leases

- Trade creditors in myriad matters related to the extension of credit and collection of monies owed

- Official Committees of Unsecured Creditors

- Defendants in preference and fraudulent conveyance actions

Fiduciaries

We have significant experience representing and advising assignees, receivers, liquidating trusts, bankruptcy trustees, and boards of directors of troubled companies.

Asset purchasers and note dispositions

One of our core strengths is representing sophisticated purchasers, including private equity and hedge funds, in acquisitions of distressed businesses and/or distressed debt. We work closely with our Corporate and Real Estate Groups to ensure that deals are efficiently completed, and all compliance issues are handled correctly.

Representative matters

Our Financial Services & Restructuring Group assesses opportunity and risk to guide commercial lenders and borrowers. Click through to read about some of our past work.

Explore past matters