Countdown to 2025: How to Prepare for Sunsetting TCJA Provisions

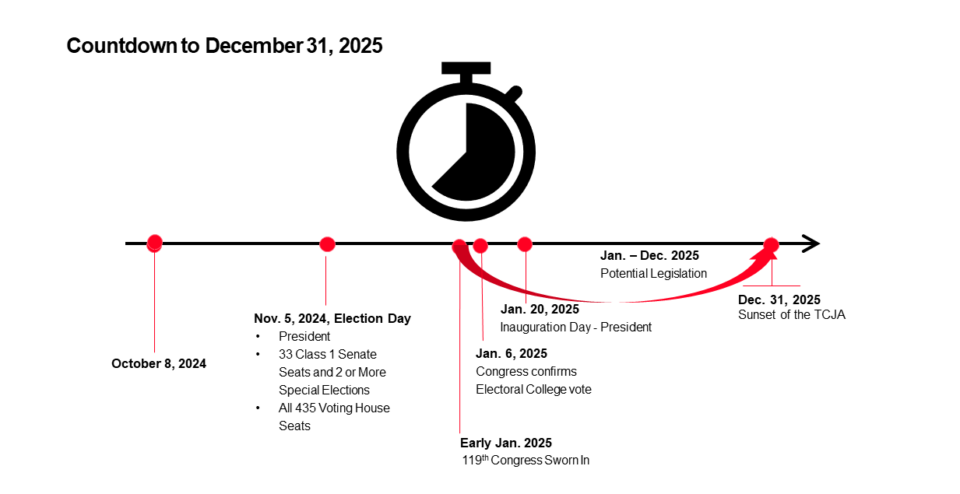

On December 31, 2025, many of the provisions of the 2017 Tax Cuts and Jobs Act (“TCJA) will expire. Before the sunset arrives, there are several things you can do to prepare for the sunset and navigate the uncertainty of the 2024 election year. In this article, we provide an overview of events that will impact TCJA provisions and strategies to optimize current tax benefits.

Permanent and Sunsetting Tax Cuts and Jobs Act Provisions

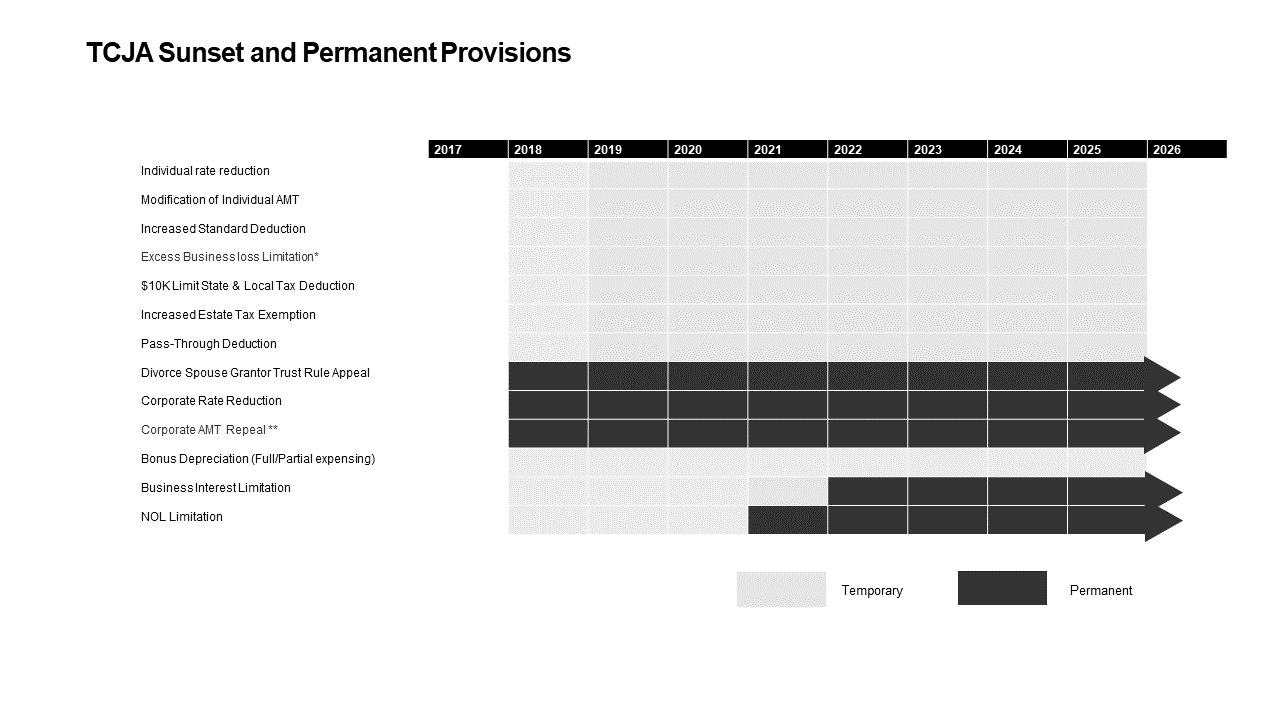

Below is a summary of the TCJA provisions that will be impacted by the sunset:

Strategies to Optimize Sunsetting Gift, Estate, and GST Exclusions

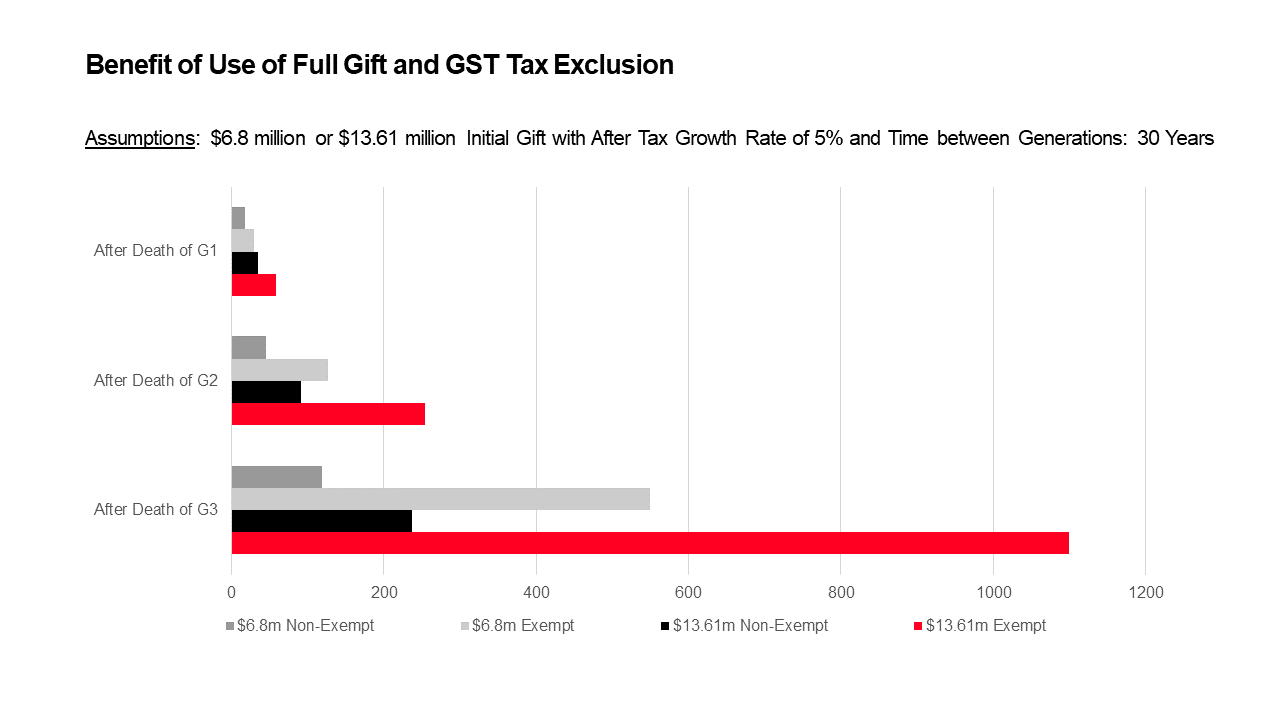

The $10m gift, estate, and GST tax exclusion/exemption (adjusted for inflation, $13.61m in 2024; $27.22m for a married couple) is scheduled to drop to $5m adjusted for inflation with the 2025 sunset. The following strategies offer ways to optimize the expiring “bonus” exclusion:

- Top off existing gift trusts.

- Cancel grantor-grantor trust notes.

- Gift to trusts to pay down or pay off debt or fund future insurance trust premiums.

- Establish new gift trusts and leverage the bonus exclusion with discounted gifts or fund gift trusts with notes.

With thoughtful planning, growth over the course of a few generations can be exponential.

Grantor Trust Divorce Remorse

In the rush to gift in irrevocable trusts before the sunset, grantors may fail to anticipate future changes in circumstances, such as divorce. Gift trusts are often designed as grantor trusts for income tax purposes such that the income tax liability of the trust flows through to the grantor. Prior to the TCJA, in the event of divorce, the income of a grantor trust paid to the former spouse of the grantor was taxed to the former spouse rather than to the grantor. However, the TCJA permanently repealed this rule. Now and after the sunset, divorce no longer alters the taxation of the income of a grantor trust. With the graying of divorce, this presents a looming tax issue which should be anticipated in the “design” of the many gift trusts that will include a spouse beneficiary or trustee that will be established in the months ahead. The following are key considerations to address:

- Including or not including a spouse as a beneficiary of a gift trust.

- Naming or not naming a spouse or a child as a trustee of a gift trust.

- Granting the trustee discretion to reimburse the grantor for income tax liabilities.

- Naming a trust protector with the power to modify trust provisions for flexibility.

Impact on Income Tax Planning

With the 2025 sunset, ordinary income tax rates will increase, and the alternative minimum tax (“AMT”) threshold will decrease. The standard deduction decreases and pre-TCJA deductions for state and local taxes (“SALT”), casualty/theft losses, moving expenses, and miscellaneous expenses will return.

The following considerations can help with income tax planning:

- Consider accelerating ordinary income (if you have no SALT deductions).

- Consider converting traditional IRAs to Roth IRAs.

- Consider deferring expenses that are not currently deductible but will be in 2026, such as SALT.

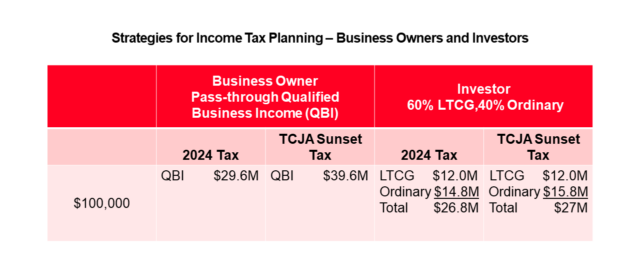

Be aware of where the real impact of the sunset lies. Business owners utilizing the qualified business income (“QBI”) deduction will experience a material tax impact unless the deduction is extended (which we think is a possibility). However, individuals with a typical investment portfolio with both capital gain and ordinary income will not be impacted as significantly as the 20% capital gain and qualified dividend tax rate will remain, and the marginal ordinary income tax rate increase from 37% to 39.6% will be offset in part in many instances by the sunset of the $10,000 SALT deduction limitation.

The LP Trusts & Estates Group is available to explore ways for clients to optimize the “bonus” gift, estate, and GST tax exclusion prior to the sunset, designing gift trusts, planning in a higher interest rate environment, and the various strategies available to minimize taxes and maximize transfers to beneficiaries.