LP for Insurance Brokers

LP has one of the nation’s most active and sophisticated insurance brokerage transactions practices, representing clients in traditional M&A (both buy-side and sell-side), capital raises, and internal perpetuation. Our clients include private equity-backed and employee-owned national and regional insurance brokers, including retail, wholesale, and specialty brokers, program administrators, and third-party administrators. We maintain close relationships with leading insurance brokerage M&A intermediaries and are regularly engaged to serve as sell-side M&A counsel to insurance agencies and their owners.

Attorneys

Steven M. Weiss

sweiss@lplegal.com

T +1 312 476 7503

Jason Romick

jromick@lplegal.com

T +1 312 476 7579

Summary deal data

Why clients choose us

We get deals done.

Our team has closed more than 500 insurance brokerage transactions. Years of feedback tell us that clients choose us because we get deals done efficiently. We don’t get bogged down with minor details, and we don’t over-lawyer transactions. We focus on what is important to our clients to achieve their goals.

We are a full-service firm, steeped in the insurance brokerage industry.

As such, we regularly advise clients not only with mergers and acquisitions, but with the wide array of ancillary legal issues that arise.

- Our Corporate Group advises on ESOP issues and business succession planning.

- Our Labor & Employment attorneys structure restrictive covenants and employment agreements, addressing the nuances of all 50 states’ laws.

- Our Real Estate Group assists with leasing and other real estate issues.

- Our Trusts & Estates and Tax Planning Groups provide pre- and post-sale tax and estate planning advice.

- Our Financial Services & Restructuring Group helps with financing matters.

We represent both buyers and sellers.

Because we’ve worked on both sides of the deal, we can anticipate and guide clients through sticking points. Further, due to the extensive number of deals we have handled, we have access to a wide range of data, client feedback, and best practices that we use to help our clients structure their transaction and navigate any issues that may arise.

“I highly recommend Steven Weiss and the team at Levenfeld Pearlstein. Steven was responsive and available, detailed and thorough, knowledgeable of the M&A process and easy to work with. My M&A consultant also found the team to be one of the best.”

—Brian Barrick, former owner of Personal Care and Assisted Living Insurance Center, LLC

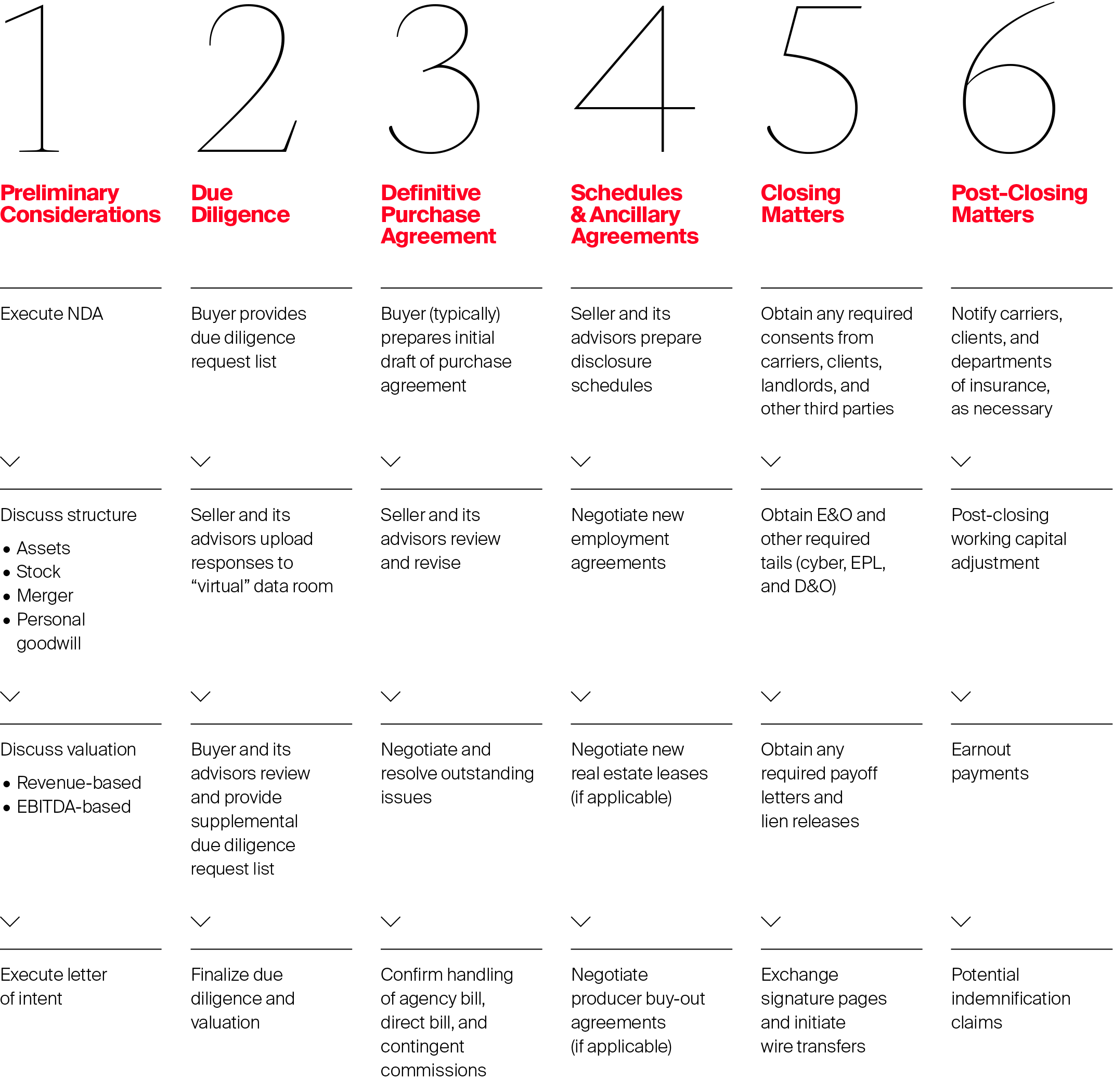

Insurance brokerage sale overview and timeline

The legal process for an insurance brokerage sale generally follows the following timeline, which typically takes 60–90 days to complete:

More information

We know the insurance brokerage industry inside and out. Whether you are a buyer, seller, or referral source, we will get your deal done efficiently and effectively.